Real Estate Rundown July 2022

July 01, 2022

With COVID being the center of vigorous change, businesses that rely heavily on real estate trends have been forced to make rapid changes just to survive as the virus throws off the balance of the housing market. Educating ourselves is one of the best actions we can take to make informed decisions to not only survive as businesses, but to thrive. We’ll fill you in on the latest trends and predictions we’ve researched this month.

With our focus on the national trends, we explore what impact we can expect with mortgage rates climbing higher and higher. We will also go over what the housing shortage means for homebuyers looking to relocate and what homeowners are buying. Finally we go over migration trends, what these movers look like, where they are primarily going and what areas they are primarily leaving.

What are the causes and impacts of ever rising mortgage rates?

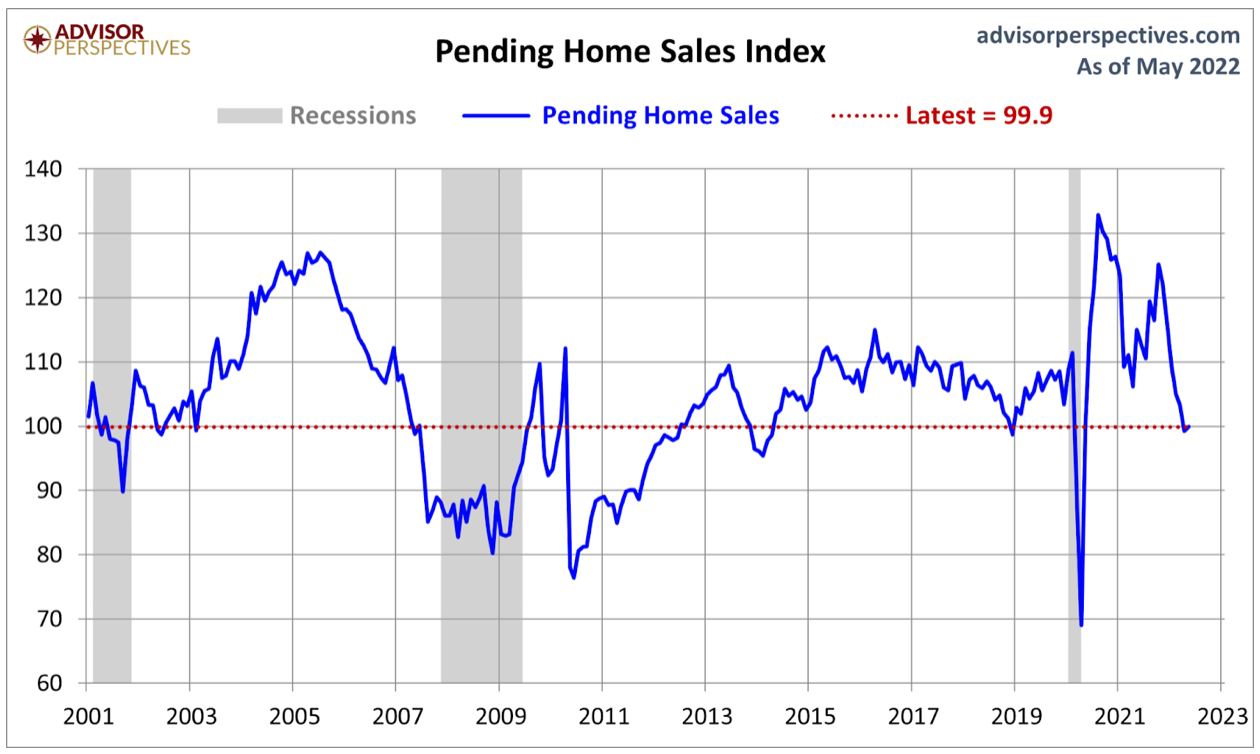

As most of us predicted, the historically low interest rates were not going to last forever. According to Zillow, mortgage rates are around 6 percent and that is the highest we have seen since 2008.

An explanation as to why we are seeing this spike is not a simple one, and even experts cannot accurately predict exactly where the rates and market will go. For example, the prediction given by some experts that the housing market would crash in 2019 is just one of many predictions that did not come to fruition.

Even though it is difficult to give a fully accurate prediction, we do know that inflation is at a 40-year high and we have seen the highest annual growth in rates since the late 70’s. Economic and geopolitical uncertainty are also known for throwing monkey wrenches into trends, and in today's climate there is a lot of unrest and uncertainty.

Housing market update

Just like mortgage rates, Zillow and Housing Wire predict home values will continue to climb in the majority of U.S. markets. Compounded with these higher rates, housing affordability will continue to be out of reach for many.

The one benefit of these climbing rates is it will allegedly ease the current buying demand. The hope is this will contribute to a small rebalancing of the market. For instance, we are already seeing price cuts being more common (due to buyers having more pull and challenging sellers). For-sale inventory is also slowly increasing, with emphasis on slow. Don’t get too excited about inventory as it is still historically low.

Moving forward, what if rates and prices go back down (hypothetically)? There unfortunately will still be affordability issues since current numbers are astronomically high and favor the highest bidder. We will see some momentum put back into housing market activity which will include more homebuyers stepping back into the ring, and sellers that were on the fence for buying listing their homes on the market. First-time homebuyers may also have a chance to engage.

Predications as mentioned earlier in this post are rocky at best based on the multiple variables that go into the housing market. Lots of experts are pointing to this shift however, so we are hoping for this balance to come back to the market sooner rather than later.

Migration trends

Even under unprecedented housing market conditions, experts are seeing the highest rate of relocation since COVID hit. Since some markets strongly lack affordability, reasonable bidding, and adequate inventory, homeowners have in full-force committed to finding more affordable options.

According to Redfin, these nomads are headed towards the Sunbelt since coastal homes in markets like New York and the Bay Area are no longer attainable. Florida remains a hot spot for these relocations, and analysis of a sample size of about two million Redfin.com users show Florida metros Miami and Tampa having the highest new inflow in April and May of 2022.

Remote work is to thank for giving these homeowners the flexibility to move to these more affordable areas of the country. According to a study conducted by Upwork, a digital platform for freelance workers, 9.3% of people (representing nearly 20 million Americans) are planning on moving because of remote work. Redfin also cites investors moving to these areas to buy up home inventory, flipping to homes, and then renting them out.

These patterns appear to be holding steady, although there has been just a slow minority moving back to New York as offices jobs open up again, and the cultural scene ramps back up.

Looking for real estate market data? Learn more at FMAdata.com or call 303-443-2070 today.

Top Industry News Housing Market Trends Top News in the Real Estate Market